Balcony Inspection Required for 3+ Multifamily Units in California

As a result of this, the following inspections bills came about.

There were two bills passed in 2018 and 2019 concerning balcony inspections where the structure is supported with wood or wood-based material.

The bill passed in 2018, SB 721, concerns properties with 3 or more multifamily units (not condominiums or other HOA property) that have a balcony, elevated walkway or staircase.

Do you have a house with two units in the rear with balcony or stair case made of wood? These are not uncommon in many residential neighborhoods, and fall under the requirements of SB 721.

What is required to be inspected

is an “Exterior Elevated Element” (EEE), which is defined as balconies, decks, porches, stairways, walkways, and entry structures that extend beyond exterior walls of the building, which has a walking surface that is elevated more than six feet above ground level and is designed for human occupancy or use.

The due date for this inspection of balconies, elevated walkways and staircases is January 1, 2025

. The inspection must be performed by a licensed contractor with an "A", "B" or "C-5" license with at least 5 years experience, or a certified building inspection. NOTE: 10-11-2024 - THE DEADLINE IS NOW EXTENDED TO JANUARY 1, 2026.

Inspections on apartment buildings must take place every six years.

Obviously, time is running out so if you fall into this category of ownership of 3+ multifamily units, you should take action as soon as possible. What is the cost? It varies according to the number of units, but one local company recently stated that their charge is $1200 for properties of 3-10 units.

Another issue owners should think about are possible requirements of proof of inspection and completion of any repairs by the owner's insurance company, which may require submission of the report.

For more information, here is a link to SB 721 as passed by the Legislature.

For more information on the 2015 balcony collapse see this Wikipedia article.

If you are interested in obtaining the name of a company to perform this inspection, please contact me.

If you are interested in a valuation of your property because you need it for insurance purposes, or you are thinking of selling it, please contact me.

Julia Huntsman, REALTOR, Broker | http://www.abodes.realestate | 562-896-2609 | California Lic. #01188996

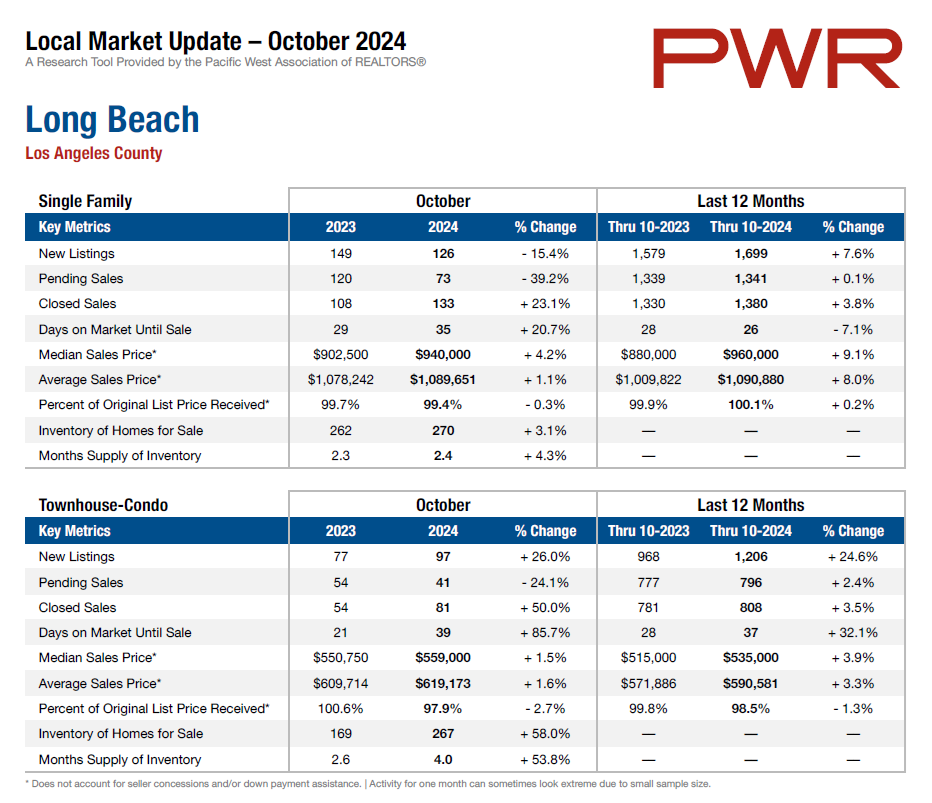

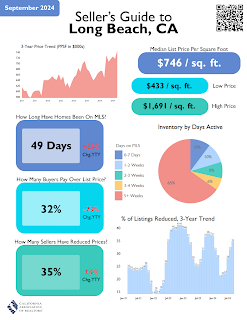

Your Market Info