Do You Have a Retirement Account?

The gap between homeowners and renters is ever widening, "The median net worth of a homeowner is about $400,000. A renter’s is just about $10,000" , according to the Aspen Institute, just one of many financial sources concerning data on wealth. Home equity is one of the ways to build wealth, people with more income also have investments. Many younger people have benefited from family money funneled into down payment, or parents who take money out of their home equity and lend or give to their child. This becomes more and more important as the market price of a home gets higher. Some people don't have family money, but don't think that you can't ever buy-- first of all, you have to realize that most people don't start at the top, they start where they can reach their goal of homeownership, which can lead them to their next goal of another home.

Homeownership creates stability, and creates a stronger community for everyone. I have worked with buyers who were not able to buy until well into their 40s. There's not an age limit for getting a mortgage (although that may be true in other countries), and there are various loan programs and down payment program available.

Find a REALTOR who can provide a buyer orientation, explain the process of mortgage and introduce you to a financial person, and explain the financial responsibilities of homeownership, whether it's a house or a condominium.

For more information to investigate on your own, go to https://www.hud.gov/counseling for information on buying, obtaining a reverse mortgage, or avoiding foreclosure. For more information on owning, buying, selling, renting, plus more, go to https://myhome.freddiemac.com and in particular, learn about credit management at https://myhome.freddiemac.com/resources/creditsmart .

Often times, a client does not want to tell their REALTOR indepth information about their financial circumstances (although certain things a REALTOR must know about about, such as down payment amount), but a client does go through much more financial disclosure with their lender. So by going to the links above, a buyer (also a seller who will become a buyer after closing escrow), will be more prepared for discussion, and planning for their future.

As a professional REALTOR for the last 30 years, I am acquainted with clients' stories, and what they have sometimes been through before buying. Please feel free to contact me with questions, I have access to a lot of information that can help you.

Julia Huntsman, REALTOR, Broker | http://www.abodes.realestate |562-896-2609 |California Lic. #01188996

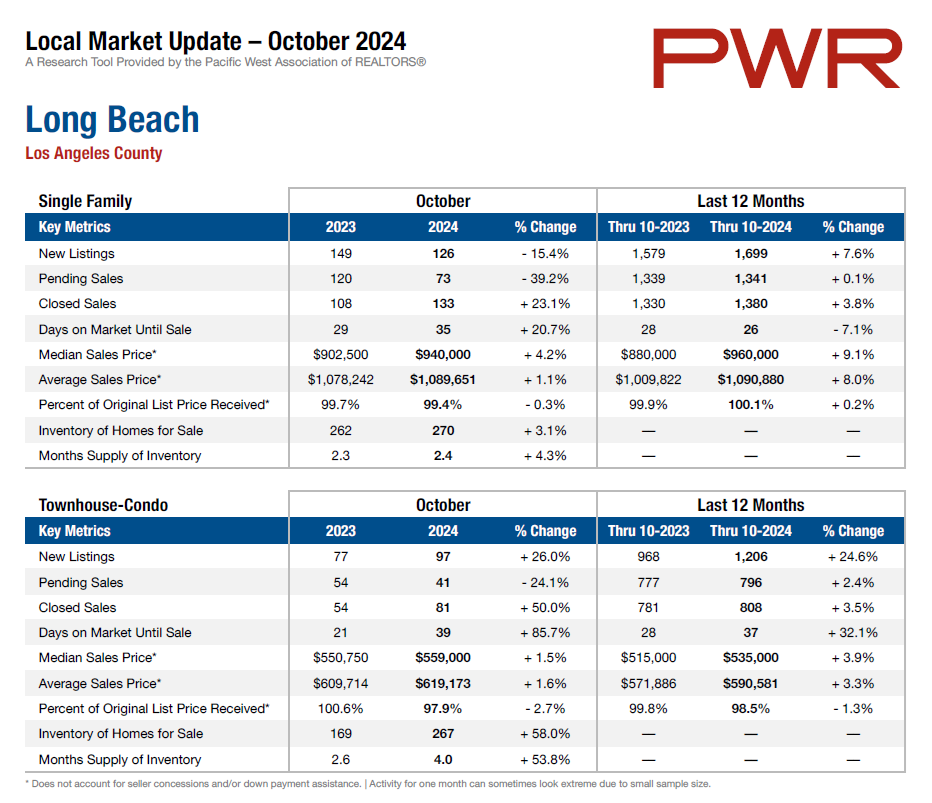

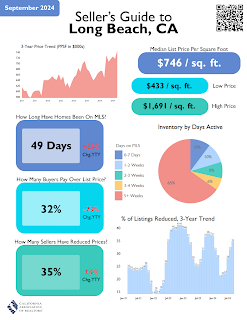

Your Market Info