New California Law Grants Foreclosure Extensions of Time When Listing and Selling a Property

|

| |

Back in September, 2024, the Governor signed a bill which would prohibit a foreclosure sale for another 45 days after a listing agreement is signed, and also prohibit a foreclosure for another 45 days after a purchase agreement with a buyer is executed. This is stating the issue simply, and as stated already, certain other guidelines must be followed. Several things must be done by the mortgage servicer, including:

"The mortgage servicer shall provide a means for the borrower to contact it in a timely manner, including a toll-free telephone number that will provide access to a live representative during business hours.

"(5) The mortgage servicer has posted a prominent link on the home page of its internet website, if any, to the following information:(A) Options that may be available to borrowers who are unable to afford their mortgage payments and who wish to avoid foreclosure, and instructions to borrowers advising them on steps to take to explore those options.(B) A list of financial documents borrowers should collect and be prepared to present to the mortgage servicer when discussing options for avoiding foreclosure.(C) A toll-free telephone number for borrowers who wish to discuss options for avoiding foreclosure with their mortgage servicer.(D) The toll-free telephone number made available by HUD to find a HUD-certified housing counseling agency.

As a borrower, you should make sure your contact information is completely current with your lender, so that if they need to contact you, you are available and are properly notified.

In Long Beach right now, there are about 203 residential and commercial properties in some stage of foreclosure, according to the property tax records; only 10 of these properties is on the market or in escrow. If you are one of these owners who are not on the market, and you haven't engaged your lender in any type of conversation, or you've received some type of notice in the mail but you haven't acted on it, you should not waste any time in contacting your lender, especially if you are interested in remaining in your home or otherwise keeping your property. Because if you don't act, you could lose your property and the equity with it.

If you are thinking of selling, you still need to be in touch with your lender, but you should also take action now in finding out what your market value is by contacting a REALTOR who can work with you on your selling requirements.

For more information on the new required timelines and procedure affecting both the mortgage servicer and the property owner, see the link below for the new law.

See the new law at AB2424 If you have any questions about what to do, please feel free to contact me and see how I can help you.

Julia Huntsman, REALTOR, Broker | http://www.abodes.realestate | 562-896-2609 | California Lic. #01188996

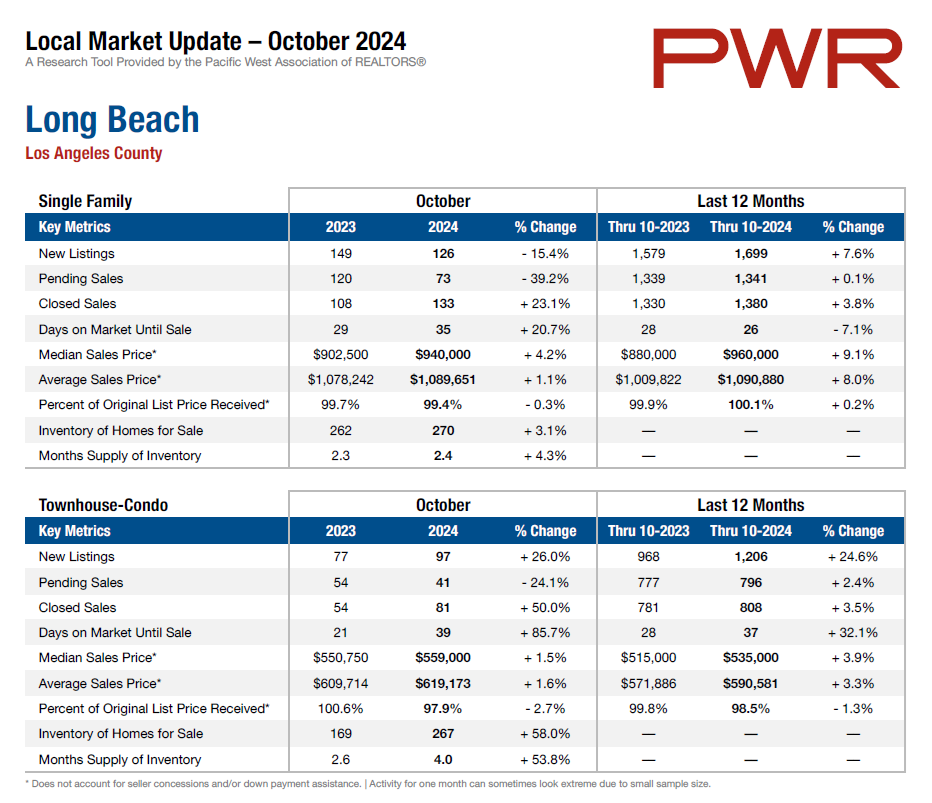

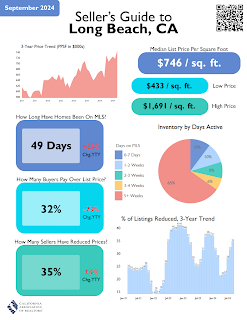

Your Market Info