Are You a California Rental Property Owner? The Upcoming Proposition for the Statewide November Ballot

Update: 7-18-2024 - taken off 2024 ballot, will be addressed lin 2025.

Update 7-15-2024, see below.

In 1995, in response to a growing number of rent control issues, the Costa-Hawkins Rental Housing Act

was enacted by the California state legislature. Today, there is a third push to repeal it in November. Known as the Justice for Renters Act, it states: "“The state may not limit the right of any city, county, or city and county to maintain, enact or expand residential rent control.” As a rental property owner, you probably know there is an increasing overlay of multiple county and municipal laws governing rents and rights of tenants, and if as a property owner you are in such a jurisdiction, then you are bound by those laws. Long Beach is one such city, so is City of Los Angeles, in total about 25 local governments which have enacted rent controls. If not in one of those jurisdictions, your property is under statewide rent control. This is important for knowing your current ability to raise rents.

The Costa-Hawkins Act made exempt single family homes, condos, townhomes and newly constructed apartment buildings from the rent control ordinances, "and allows landlords to reset the rental rate on rent-controlled rental

units where they become vacant or where the last rent-controlled tenant

no longer permanently resides at the unit." The ability to reset the rents after, for instance, a long-term tenant who has been paying less than market value rents, is a property owner right under the Costa-Hawkins Act. The above proposed Justice for Renters Act would eliminate the owner's ability to charge the market rate when a tenant vacates, or "vacancy decontrol".

But if this proposition should pass, property owners would no longer have the protections of the Costa-Hawkins Act but would instantly activate whatever local jurisdiction controls are already in place, many of which are more restrictive. Should an owner not be able to bring rents to market value, but rather be subject to some much lower rent increase requirement, their entire property value would be devalued, along with less funds to maintain a property, rising property taxes, increasing property insurance, and increasing utilities, and which will also be charged fees at current market rates by contractors to do their work. While a simplified picture for tenants is that they may pay less money if they have rent control, they may also be living in a less enhanced, less attractive, non-turnkey property over time, with repair issues. Such strict rent control could affect the smaller properties in the rental market as those owners exit due to financial constraints, thus causing lower availability of housing for renters and lower quality. UPDATE 7-15-2024: Now known as Proposition 33 on 2024 ballot:

"Proposition 33, rent control: A vote in favor of this measure would expand rent control in California. If the proposition passes, it would get rid of a nearly three decade-old law, known as the Costa-Hawkins Rental Housing Act, that bans rent control on single-family homes finished after February 1, 1995.

"Cities and counties would have more power to limit rent increases for incoming and existing tenants, making it harder for landlords to hike up prices. The measure would also insert new language into California law that prohibits the state from limiting how cities and counties expand or maintain rent control. It’s backed by the Aids Healthcare Foundation and is the third time since 2018 that voters will decide on the issue: Similar ballot initiatives, in 2018 and 2020, failed by 19 and 20 points, respectively." https://www.sacbee.com/news/politics-government/capitol-alert/article289594036.html

If passed, this proposed Act could only be repealed by another ballot initiative, it does not address the statewide housing shortage, or address homelessness.

It's important to not lose the Costa-Hawkins Act, it still maintains property rights for owners, which are being eroded with each passing year.

Go to Californians for Responsible Housing

for more information on the effect of repealing the Costa-Hawkins Act.

Julia Huntsman, REALTOR, Broker | http://www.abodes.realestate | 562-896-2609 | California Lic. #01188996

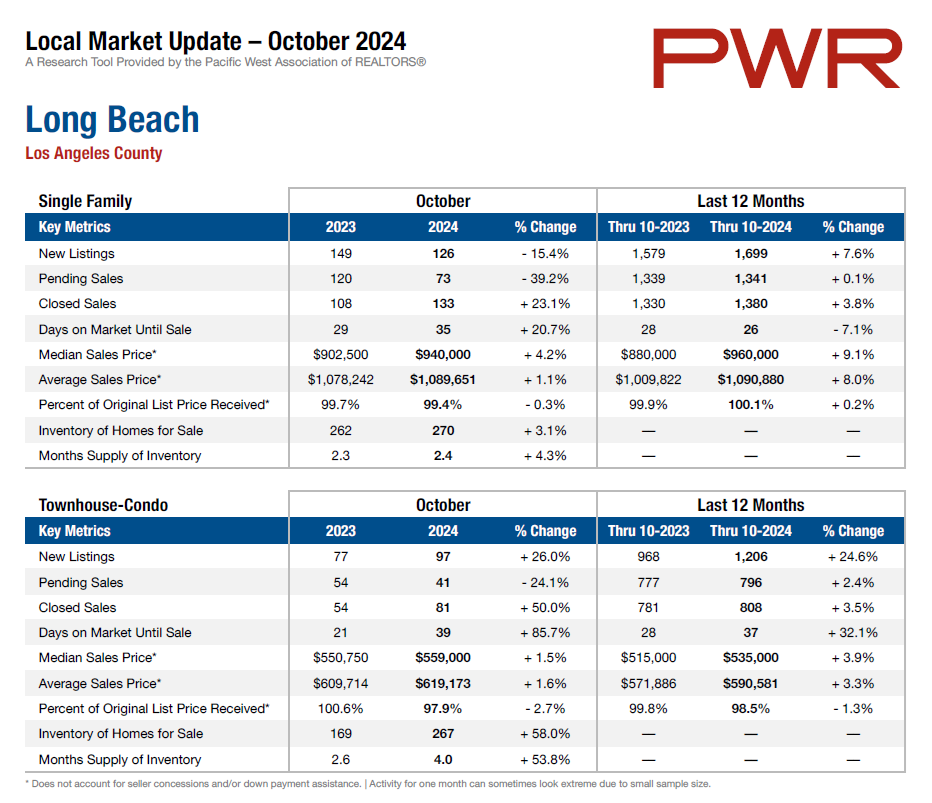

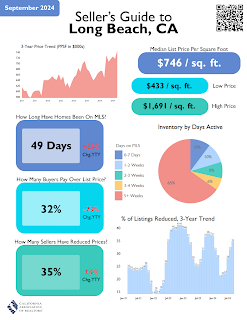

Your Market Info