8 Eye-Opening Things Home Inspectors Can’t Tell You

What’s included in a home inspection may not be as important as what isn’t.

A home inspection may feel like a final exam, but it’s not quite so clear cut. Your inspector’s report won’t include a clear-cut A+ if a house is a keeper or an F if it’s a money pit.

What is included in a home inspection report is a set of neutral facts intended to help you decide on a home’s final grade.

Oh sure, a seasoned inspector will know if a home is a safe bet or full of red flags. But they’re actually bound by a set of rules that limit what they can tell you.

Here’s what they can’t say:

#1 Whether They Would Buy This House

Here’s the big one: Many buyers think an inspector will give them a thumbs up or thumbs down, but they can’t. Giving real estate advice violates the International Association of Certified Home Inspectors’ code of ethics.

Clues to look for: Count up your issues. “The average inspection turns up around 20,” says Larry Fowler, a home inspector in Knoxville, Tenn., who has done around 10,000 home inspections in his 22 years in the business. “If there are more than 30 items, you may have a bad house,” Fowler adds. “If there are fewer than 10 items on the list, you may have a bad inspector.”

The bottom line is that every house and buyer are unique and what inspection results one person is fine with, another may not be. Confer with your agent once you have the report.

#2 If It Has Termites, Rats, or Mold

Yikes! You might assume this trio of homewreckers would be part of every house inspection checklist, but your inspector isn’t licensed to look for them.

Clues to look for: Inspectors can note that those sagging floors are evidence of termites, or that shredded insulation is evidence of rats, or the black stuff on the walls is evidence of fungal growth. To turn evidence into proof, ask a specialist for a follow-up inspection.

#3 If the Pool or Septic System Are in Good, Working Order

Home inspectors aren’t certified to inspect everything that could appear in any home. So for example, if there’s a pool, some may turn on the pool pump and heater to make sure they work, but they won’t look for cracks or plumbing leaks. You’ll need to find a pool inspector. In other cases, you may need a septic systems or wells expert, an asbestos or radon specialist, etc.

Clues to look for: Any special feature is your cue to find a specialist. “We’re general practitioners,” Fowler says.

And here’s a bonus tip: Consider a home’s advanced age a “special feature,” as they’re likely candidates for lead paint, asbestos, and other old-home hazards.

#4 That They’re Making The House Look Worse Than It Is

Some inspectors make note of every tiny thing in a house, even inconsequential ones. Like chipped paint. Scratched windows. Surface mold in a shower. These folks are sometimes known as deal killers.

Clues to look for: If your inspector’s report is pages long and full of items that won’t hurt the value of the home, it’s probably not a big deal. Sit down with your agent, and go through the report to determine which (if any) issues could affect your offer.

Note: See sample inspection reports from around the country at the International Association of Certified Home Inspectors website.

#5 If That Outlet Behind the Couch Actually Works

An inspector can only check what they can see without moving anything. This means the foundation could be cracked behind that wood paneling in the basement. Or the electrical outlet behind the sofa might not work.

Clues to look for: The inspector should note if they’re unable to inspect something critical. Consult with your agent about what to do, such as asking the seller to take down the paneling or offering to pay to have it removed. Alternately, offer a lower price.

#6 Whether They’ve Inspected the Roof Closely

Some inspectors will climb up on the roof to look closely at shingles and gutters — but they’re not required to. If it’s raining or icy, or the roof is steep or more than two stories high, they can stay on the ground and report what they can see from there.

Clues to look for: They should note whether they walked the roof, but if it’s not clear, ask. If they haven’t, keep this in mind when evaluating their roof inspection report. They should still note any missing or damaged gutters or downspouts and the general condition of the roof based on what they can see from the ground.

#7 What You Should Freak Out About (or Not)

It’s an inspector’s job to find things wrong with the house. Big things, little things, all the things. It’s not their job to categorize them as NBD or OMG. A checkmark next to a crumbling foundation will look the same as a checkmark next to chipped paint.

A few things you may find on an inspector’s report that aren’t a big deal:

- Condensation in a basement or crawl space

- Early signs of wood rot on trim

- Cracks in bricks from the house settling

- Faux stone siding that’s been improperly installed

- Radon levels below 4 pCi/L

These items, however, could trip your freak-out response (if you’re not prepared to address them):

- Standing water in a basement or crawl space

- HVAC not working

- Outdated wiring, especially knob-and-tube wiring or aluminum wiring

- Wood rot

- Old plumbing pipes

- Radon levels above 4 pCi/L

#8 Who They’d Recommend to Fix It (and How Much It Will Cost)

Your inspector may seem like the perfect source of insider info on repairing issues they see all the time, but the opposite is actually true.

You don’t want your inspector to make financial decisions based on their report. Think about it: If an inspector’s buddy Steve gets a plumbing gig every time a certain issue turns up on a report, it gives that inspector some pretty big (and not cool) motivations to find that issue.

Even giving you a price range for the repair is off-limits. It’s not their area of expertise, it creates a conflict of interest (they could be endorsing Steve’s great deal, after all), and, perhaps most importantly, it’s against the ethics rules.

Clues to look for: This is good home ownership practice. Try to price out every item on your home inspector’s report, big and small. Do some research, and call three contractors or check out three retailers for the service or part needed to resolve each issue. You’ve got this, future homeowner!

This and other helpful articles are on HouseLogic. Find more information, and a list of member home inspectors, at https://www.creia.org/resources-for-home-owners-realtors.

Julia Huntsman, REALTOR, Broker | http://www.abodes.realestate | 562-896-2609 | California Lic. #01188996

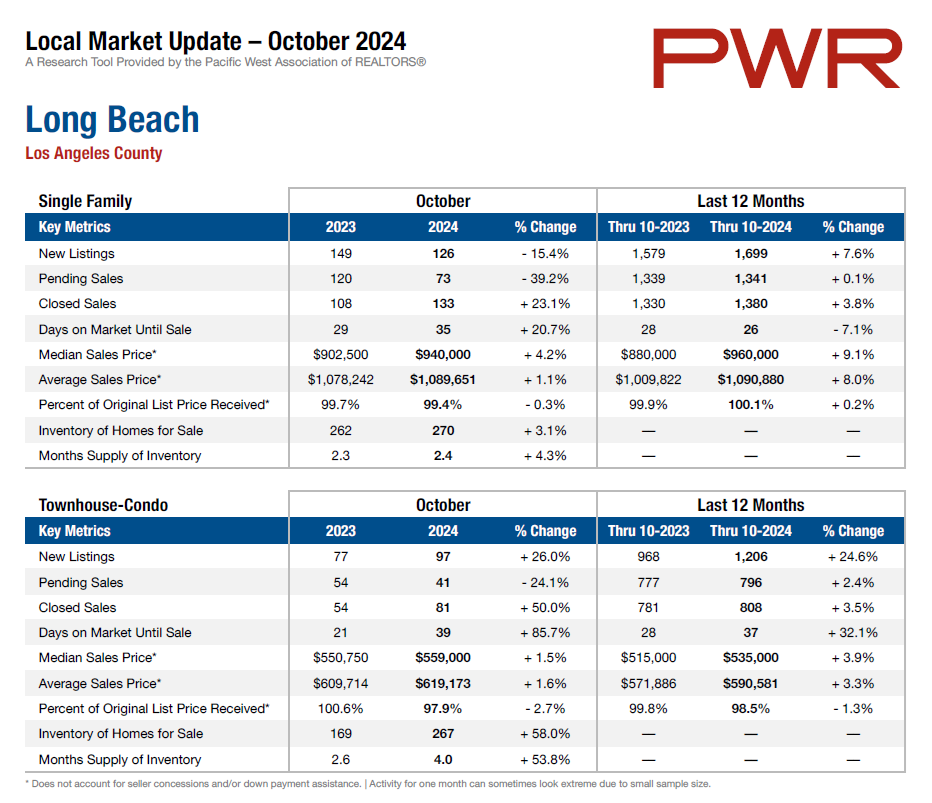

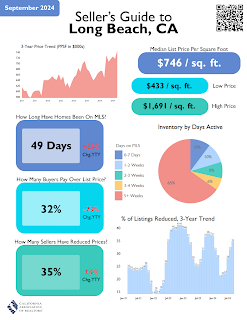

Your Market Info